vermont state tax exempt form

How to use sales tax exemption certificates in Vermont. 97417 26 27 34 Form S-3F Note for the BUYER.

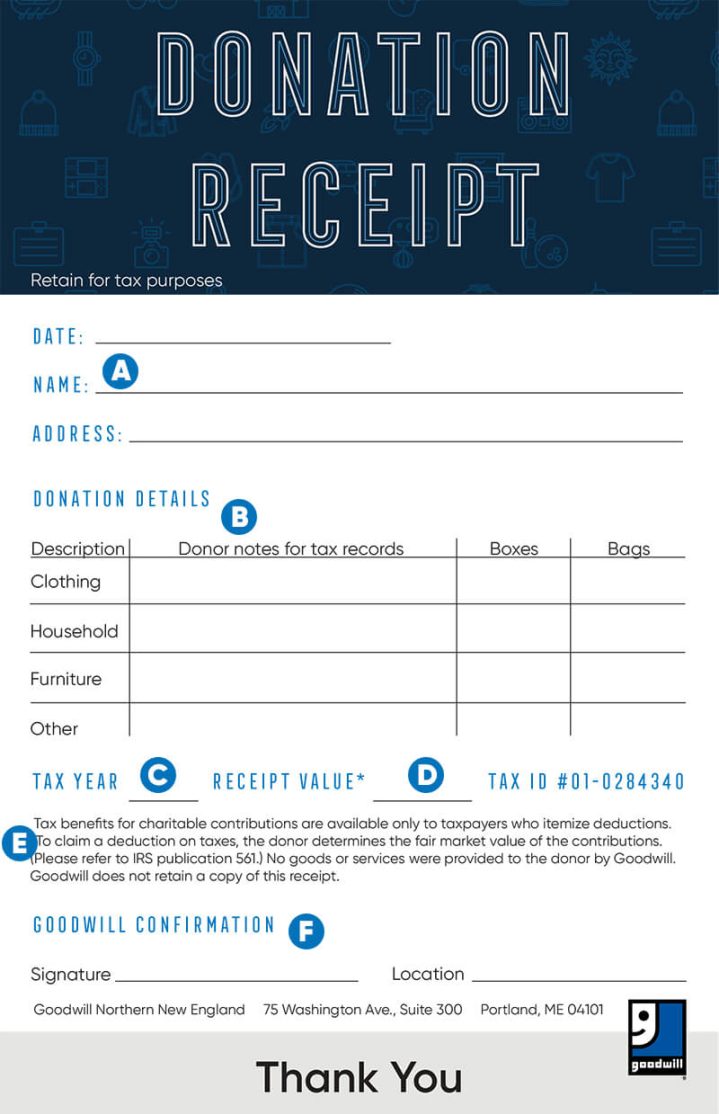

How To Fill Out A Goodwill Donation Tax Receipt Goodwill Nne

Office of Veterans Affairs 118 State Street.

. Beginning July 1 2018 sales of advanced wood boilers are exempt from Vermont Sales and Use Tax. Act 194 S276 Secs. Ad Download or Email VT S-3M More Fillable Forms Register and Subscribe Now.

0617 Page 1 This form may be photocopied. State government websites often end in gov or mil. Standard Contract for Services 12-12-2018 - Revised.

An eligible veteran lives in a home valued at 200000. When you use a Government Purchase Card GPC Click to define. This vehicle is also classified as a Jitney and should be registered as such.

City State ZIP Code. 2022 2023 Religious Exemption Form Childcare and K-12 Author. Buyers and sellers of wood boilers should review the questions and answers below to understand how the exemption is applied.

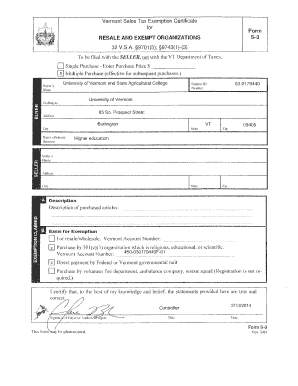

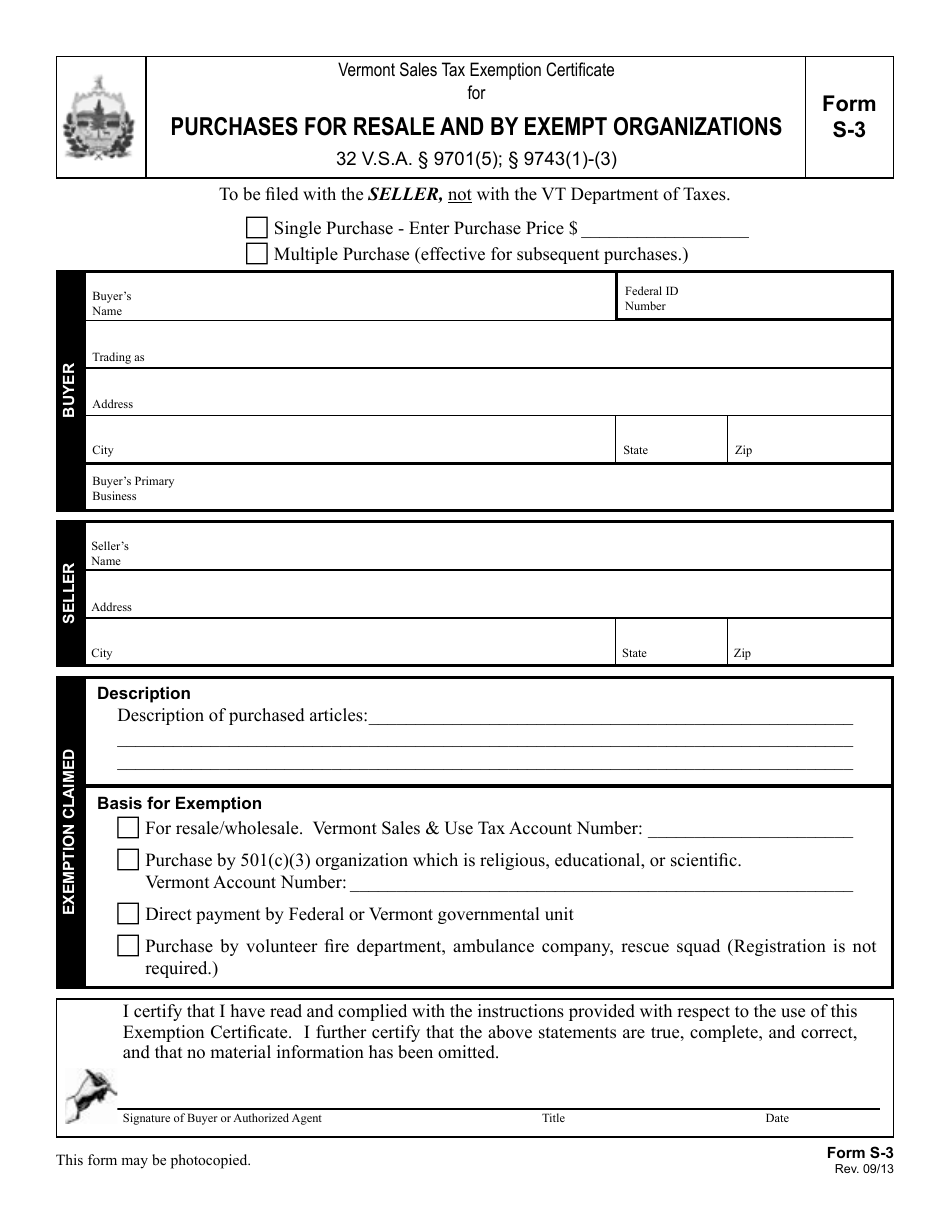

97413 974125 Form S-3A FSingle Purchase - Enter Purchase Price _____ FMultiple Purchase effective for subsequent purchases Buyers Name Address City State Zip EIN or SSN Telephone BUYER. Friday May 24 2019. B-2 Notice of Change.

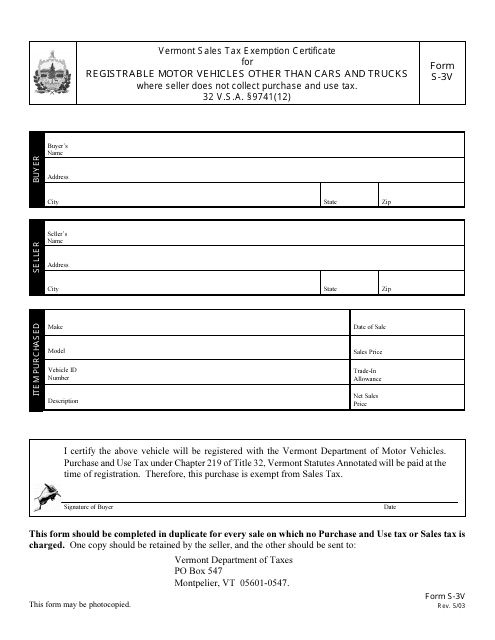

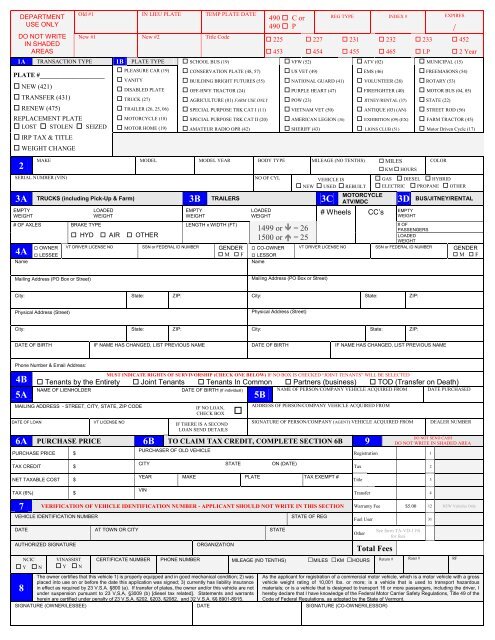

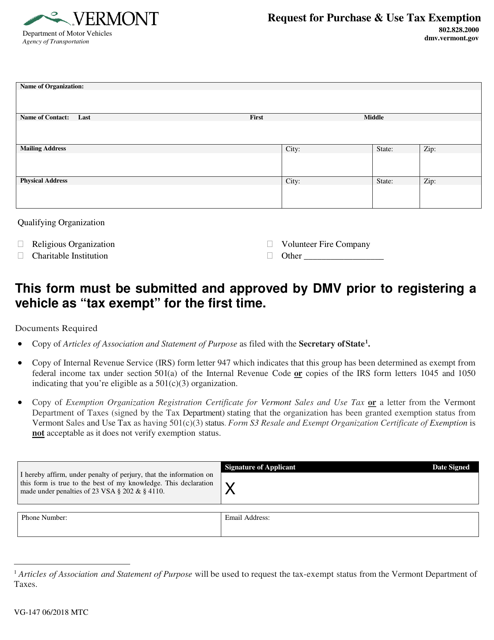

Tennessee TN Exempt from Sales and Use tax. The certification is on an exemption form issued by the Vermont Department of Taxes or a form with substantially identical language. Registration Tax and Title Application form VD-119 must also be completed.

Vermont Department of Health Created Date. Form S-3F Page 1 of 3 Rev. A tax-exempt form is a form that excuses an organization from paying taxes.

IN-111 Vermont Income Tax Return. Ii the Maximum Amount is more than. 32 VSA 9741 52.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. Wwwveteransvtgov PROPERTY TAX EXEMPTION FOR DISABLED VETERANS AND THEIR SURVIVORS The State of Vermont offers a property tax discount reduction on the assessed value of the primary. Exemption for Advanced Wood Boilers.

Make Model Year YYYY. Centrally Billed Account CBA cards are exempt from state taxes in EVERY state. Form 29 Application for Exclusion from.

The exemption level varies from town to town. W-4VT Employees Withholding Allowance Certificate. Tax Exempt Form Vermont 2022 What is a Tax Exempt Form.

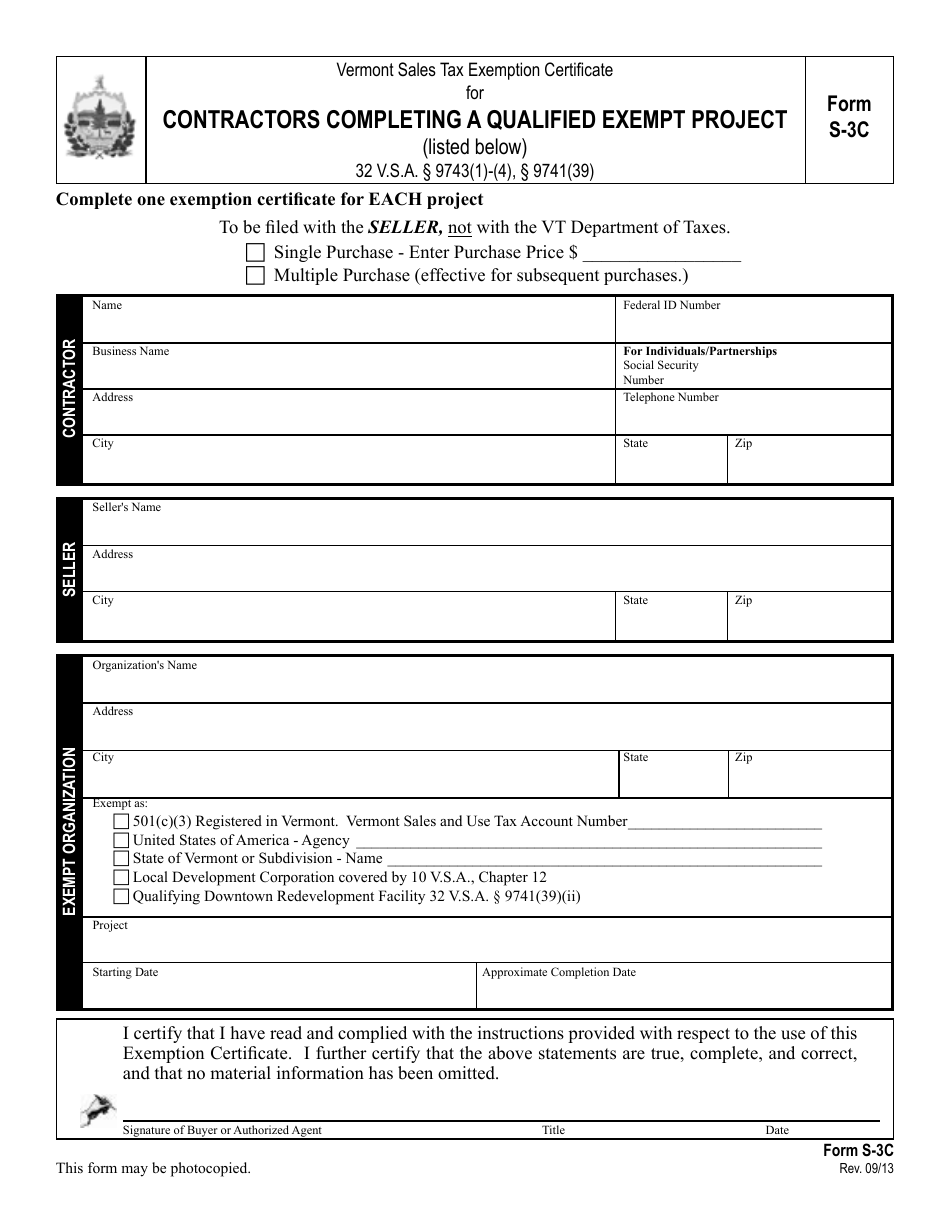

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Download Or Email Form S-3C More Fillable Forms Register and Subscribe Now. The certificate is signed dated and complete all applicable sections and fields completed.

Such as the GSA SmartPay travel card for business travel your lodging and rental car costs may be exempt from state sales tax. Use of this Short Form is not authorized and the Standard State Contract Form must be used if any of the following apply. Registrant or lessee must be licensed in Vermont as a VT Rental Company and will be required to submit a completed Rental Tax Exemption form VD-030.

Vermont Sales Tax Exemption Certificate for Fuel or Electricity 32 VSA. SELLER continued on next page Form S-3A Page 2 of 4 Rev. I the Contract Term is more than 12 months.

Montpelier VT 05620-4401 Or Fax to. If a Gift Tax Exemption claim is submitted with a registration or title and tax application that lists a lienholder the. Standard Contract form template for Services.

VT-013-Gift_Tax_Exemptionpdf 20754 KB File Format. The buyer must read and follow all instructions prior to completing and signing. That means that items available under the exemption are only available as exempt if the purchaser will use the equipment 75 or more of the time for exempt usesThis declaration is made at the time of purchase by filling out Form S-3A Agricultural Fertilizers.

Vermont Department of Motor Vehicles 120 State Street Montpelier VT 05603-0001. The IRS defines a tax-exempt company as an entity that does not need to pay income taxes and does not have to submit a federal tax return. June 16 2021.

Ad Download Or Email Form S-3 More Fillable Forms Register and Subscribe Now. The exemption available to agricultural and horticultural entities for machinery and equipment is a use-based exemption. Vermont follows the federal IRS designations for tax-exempt nonprofit organizations found in federal law at 26 USC.

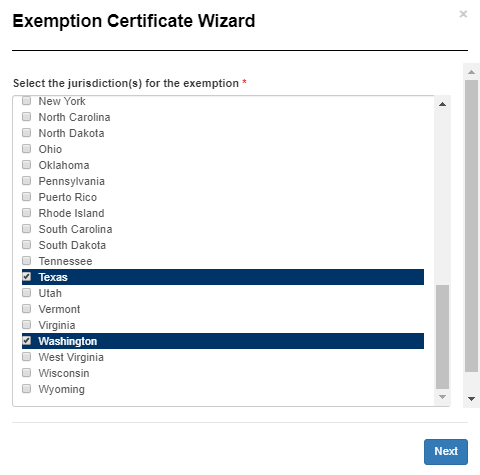

No reciprocity with State of Vermont per 1-800-TAX-9188. Exemption from state Sales and Use tax applies to hotel occupancy. Ad Download Or Email Form S-3C More Fillable Forms Register and Subscribe Now.

Certain states require forms for CBA purchase cards and CBA travel cards. Before sharing sensitive information make sure youre on a state government site. Form 29 Application for Exclusion from Provisions of the Workers Comp Act rev 2-13.

120 State Street Montpelier Vermont 05603-0001. The property purchased is of a type ordinarily used for the stated purpose or the exempt use is explained. Form S-3F Vermont Sales Tax Exemption Certificate for Fuel or Electricity isompleted c if the use is not obvious or if only a portion.

City State ZIP Code. The company can be a charitable religious or educational institution. This form may be photocopied.

The exemption reduces the appraised value of the home prior to the assessment of taxes. Some of these exempt nonprofits must pay Vermont taxes or collect. PA-1 Special Power of Attorney.

To request exemption of tax based upon gift when a vehicle was previously registered andor titled by the donor and is gifted with no money exchange and no current lienholder to be listed to a family member as defined acceptable by this form. Vermont Sales Tax Exemption Certificate for AGRICULTURAL FERTILIZERS PESTICIDES MACHINERY EQUIPMENT 32 VSA. PA-1 Special Power of Attorney.

Standard Short Form 12122018 Revised. State law mandates a minimum 10000 exemption although towns are given the option of increasing the exemption to 40000. Of the conditions outlined on this form must be met to qualify for a tax exemptionIf not tax is due at time of.

IN-111 Vermont Income Tax Return. Provide vendor with federal exemption IRS determination letter PDF in lieu of certificate of exemption from TN Commissioner of Revenue as an out-of-state exempt organization. B-2 Notice of Change.

Sales Tax Exemption Certificate Fill Online Printable Fillable Blank Pdffiller

Instructions On Obtaining A Resale Certificate Sales Tax License

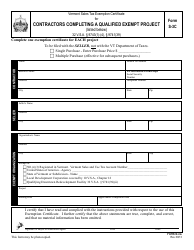

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Registration Tax Title Application Vermont Department Of Motor

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

Complete And E File Your 2021 2022 Vermont State Tax Return

Printable Vermont Sales Tax Exemption Certificates

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

Tax Exemption Certificate Wizard Support Center

Sales Tax Exemption For Building Materials Used In State Construction Projects

Scott Signs Tax Exemption Bill For Tribal Lands

Form Vg 147 Download Fillable Pdf Or Fill Online Request For Purchase Use Tax Exemption Vermont Templateroller

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller